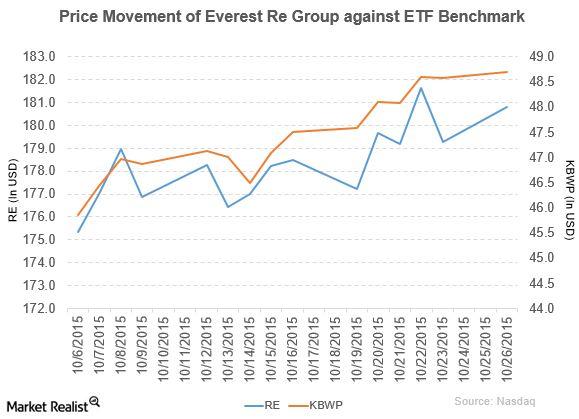

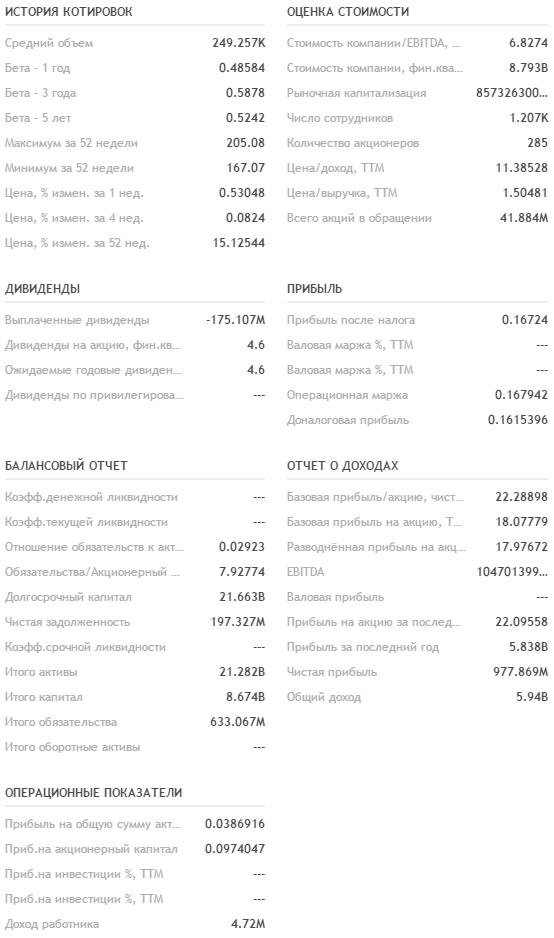

Turning out attention to how the Everest Re Group Ltd. Investors will no doubt be excited to see the share price fall to $430.00, which is the median consensus price, and at that level RE would be -15.68% from recent price. Based on this estimate, we see that today’s price at last check is roughly -2.23% off the estimated low and -25.36% off the forecast high. Considering analysts have assigned the stock a price target range of $380.00-$466.00 as the low and high respectively, we find the trailing 12-month average consensus price target to be $426.13. (NYSE:RE)’s beta value is holding at 0.60, while the average true range (ATR) indicator is currently reading 8.30. The indicator jumps to 2.01% when calculated based on the past 30 days. The Relative Strength Index (RSI) metric on the 14-day timeframe is pointing at 46.64, with weekly volatility standing at 1.88%. The overview shows that RE’s price is at present -1.59% off the SMA20 and 1.66% from the SMA50. If we dive deeper into the stock’s performance we see the positive picture represented by the PEG ratio, currently standing at 1.91.

Looking at the stock’s medium term indicators we note that it is averaging as a 100% Buy, while an average of long term indicators are currently assigning the stock as 100% Buy. On the technical perspective front, indicators give RE a short term outlook of 50% Buy on average. Revisions to the company’s EPS highlights a short term direction of a stock’s price movement, which in the last 7 days came up with no upward and no downward reviews. Per this projection, the revenue is forecast to grow 14.30% above that which the company brought in 2023. Staying with the analyst view, there is a consensus estimate of $13.47 billion for the company’s annual revenue in 2023. The average estimate suggests sales growth for the quarter will likely rise by 13.60% when compared to those recorded in the same quarter in the last financial year. On average, analysts have forecast the company’s revenue for the quarter will hit $3.31 billion, with the likely lows of $3.29 billion and highs of $3.37 billion. In this case, analysts estimate an annual EPS growth of 69.40% for the year and 25.30% for the next year. Analysts tracking RE have forecast the quarterly EPS to grow by 11.74 per share this quarter, while the same analysts predict the annual EPS to hit $45.86 for the year 2023 and up to $57. It is understandable that investor optimism is growing ahead of the company’s current quarter results.

The company stock has a Forward Dividend ratio of 6.60, while the dividend yield is 1.74%. Like we said, the boom is accelerating – and the time to buy EV-related tech stocks is now.Įverest Re Group Ltd., which has a market valuation of $14.91 billion, is expected to release its quarterly earnings report – Jul 31, 2023. If you want to remain at this site, select the CANCEL button.According a new report published by BloombergNEF on investment in the energy transition, annual spending on passenger EVs hit $388 billion in 2022, up 53% from the year before. By clicking on the CONTINUE button below, you acknowledge the previous statement and will be taken to the linked site. Be aware that the privacy policy and security controls of the linked website is not that of Everest and the linked website may provide less security than Everest's site. If you decide to leave Everest site and access third-party linked websites, you do so at your own risk and Everest will have no liability arising out or related to such linked third-party websites. and its affiliates have no control over any of these third-party sites, or content, and make no representations or warranties with respect to the information contained therein, and take no responsibility for supplementing, updating, or correcting any such information. These third-party links are being provided as a convenience and for informational purposes only they do not constitute an endorsement or an approval by Everest of any of the products, services or opinions being offered by the third-party. By accessing this link, you will no longer be on the Everest site.

0 kommentar(er)

0 kommentar(er)